Contents

The bearish trend also follows the same logic but in reverse. Fibonacci Extensions are external projections greater than 100% and can help locate support and resistance levels. Take note that after the marked blue base line, the price starts a sharp increase which reaches the 261.8% extension area. Notice that the price creates a couple of tops there , which shows that the price is clearly finding resistance at this level.

Extension levels are also possible areas where the price is expected to reverse. In his historic 13th century novel Liber Abaci , Leonardo Fibonacci brought a special sequence of numbers known as the Fibonacci series to Western civilization. Before we look into how Fibonacci numbers and ratios are used in the financial markets to predict future support and resistance levels, let’s have a look at where they came from and… In the chart above, price was rejected twice at the ~$35.50 level, forming a double top which is a fairly strong reversal pattern. To help identify potential areas of support and resistance we have drawn a Trend-Based Fib Extension. The first case is when the price approaches the 0% Fibonacci retracement level for the third time.

Often, traders who have no prior experience with Fibonaccis are worried that they are ‘doing it wrong’ and they then don’t use the Fibonacci tool at all. I can assure you, there is no right or wrong when it comes to drawing Fibonacci and you will also see that different traders use Fibonacci in slightly different ways. It is a trend momentum tool that sets out the levels where the price can reach. You can use the Fibonacci Extension tool in any timeframe to set your trading targets. ANY of these levels may or may not act as support or resistance.

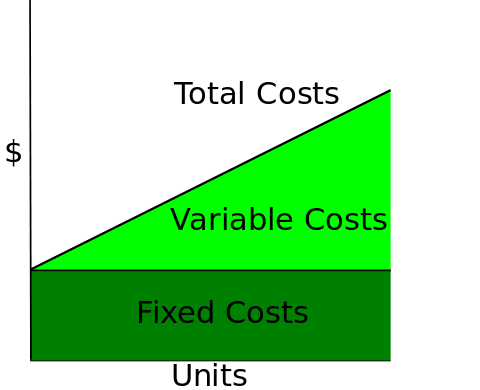

AO gives us a bearish saucer, which signals us to keep our short trade. In the red circle we see the moment when the AO breaks the bearish trend. Fibonacci extensions are a tool that traders can use to establish profit targets or estimate how far a price may travel after a pullback is finished. Extension levels are also possible areas where the price may reverse. Using Fibonacci retracement and extension levels works best after strong and obvious price swings.

5) Ability to stand out from the market when we do not understand what is happening. It is not that who is right among the above, or who is the best, but the skills of an individual trader can be eithir of the above three competencies or blend of those. If you are looking to trade forex online, you will need an account with a forex broker. If you are looking for some inspiration, please feel free to browse my best forex brokers. IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support. In this connection, it should be said that the method is good during active sessions.

Then, the price starts a consistent bearish trend, which we have marked with the magenta trend line on the chart. Notice that at the end of the swing marked in blue, there is a Doji candle that foretold the possible price stall and reversal on the chart. The price reversed, and the GBP/USD started increasing until the 161.8% Fibonacci extension was reached. After the price had reached this level, it started to hesitate and lose steam to the upside. And so it is important to understand that there is no such thing as knowing exactly how far a price move will go. You can always set a minimum target at the next Fibonacci extension.

Fibonacci Extensions

The price may not stop or reverse right at the level, but the area around it may be important. For example, the price may move just past the 1.618 level, or pull up just shy of it, before changing directions. Let’s put up that Fib Extension tool to see where would have been some good places to take profits had we shorted at the 61.8% retracement level.

- If the market is trending up, then, pullbacks move downwards, so the retracement levels will serve as possible support levels.

- We will analyze the options separately for the upward and downward markets.

- Fibonacci retracement works in every time frame and in every segment.

- However, it is important to assess and analyze market conditions at each level of the Fibonacci extension.

- For instance, dividing a number by the number two places to the right — say, 89 divided by 233 — would give 0.382 (38.2%), which is one of the Fibonacci retracement levels.

The result of this operation will be the display of an expansion grid with default levels of 61.8%, 100%, 161.8%. Fibonacci extensions are not meant to be the sole determinant of whether to buy or sell a stock. Investors should use extensions along with other indicators or patterns when looking to determine one or multiple price targets. Candlestick patterns and price action are especially informative when trying to determine whether a stock is likely to reverse at the target price.

Shorting Stocks

These are considered internal retracements that are measured inside of a specific swing being analyzed. But there are important Fibonacci levels that extend beyond the 100% level and where price action tends to react regularly. For doing this, one must view the markets on higher time frame objectively and not through some sell/buy signal through systems. We are picking out only select stocks (5-8) and will be tracking them for Swing trades.

Therefore, if there is strong volume in conjunction with a Fibonacci extension breakout, this gives us further validation of our trading signal. The KST indicator could also indicate an underlying divergence in the stock price. It works the same way as with the awesome oscillator with the one difference that the KST has lines and not bars. The price could move upwards while the KST creates lower tops or bottoms – bearish divergence.

How to use Fibonacci retracements and extensions?

When the stock price breaks a Fibonacci extension, I will first confirm it with the KST before entering the market. When I see an extension break, I need the two KST lines to cross upwards in order to go long. Conversely, I need the two KST lines to cross downwards to go short. We hold the position as long as the KST supports the price direction. We exit the market when the KST lines cross in the opposite direction. Twitter starts a consolidation around 1.618; meanwhile, we get three bullish saucers from the AO, which supports our long position.

While no indicator or tool is 100% accurate, the fib retracement lines can be very effective when they are applicable. This is why they should only be another tool in a trader’s arsenal and not the sole tool. Many traders use the Fibonacci retracement levels in combination with the trend line and other technical indicators as a part of their trend trading strategy. They use the combination to make low-risk entries into an ongoing trend and form a confluence that helps make better trading decisions. To calculate Fibonacci retracement levels, technical analysts draw six lines on an asset’s price chart. The first three are drawn at the highest point (100%), the lowest point (0%) and the average (50%).

Mistakes to avoid when trading with Fibonacci retracement levels

The impulse waves move in the direction of the trend, while the corrective waves move in the opposite direction. It suggests placing the stop-loss level beyond the level of current trade. When this distance is too long from the entry point, then the use of a swing top/bottom closer to entry point is suggested. However, it is important to assess and analyze market conditions at each level of the Fibonacci extension. Moreover, consideration of other factors such as the average daily range and volatility increases the odds of setting better take profit targets. For example, more volatility indicates possibilities of bigger moves and vice versa.

First, click on a significant Swing Low, then drag your cursor and click on the most recent Swing High. Finally, drag your cursor back down and click on any of the retracement levels. You determine the Fibonacci extension levels by using three mouse clicks. I have personally only ever used Fibonacci levels on the chart I was trading from. I haven’t tried to draw Fibonacci levels on, for example, the daily chart to use while taking entries on the 4H chart. That is a significant distinction because those levels often act as support and resistance and the indicator doesn’t need to be very intelligent to plot them.

How to Use Fibonacci Retracement and Extension Levels

If the indicator shows a value below 30, this indicates an oversold currency pair, and vice versa, a value above 70 indicates its overbought. We will analyze the options separately for the upward and downward markets. Fibonacci extension – reversal zonesThis is the same GBPUSD chart, with the same 1-hour timeframe, but a candlestick chart type.

The key Fibonacci extension levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%. As you can see from the example, the 61.8%, 100%, and 161.8% levels all would have been good places to take off some profits. I also mentioned that Fibonacci retracements aren’t usually used alone to enter trades. Rather, they are used in combination richest tech companies with other factors in a trading plan to build a case possible entries. If you’re waiting to enter a trade on the retracement of a move, there is a sweet spot in which you’d like to see price bounce and hopefully continue the in the original direction. That sweet spot ranges from about the 38.2 level to the 61.8 level.

After a sharp drop in prices, a clue appeared for the Fibonacci expansion of 1.618. Notice how the price tried thrice to break the 61.8 level and then fell back to the 100.0 area where it consolidated and reversed sharply. Check if there are coincidences between the resulting levels and the movement of the chart. If they are absent, correct the baseline to match the levels with the formations of the chart. A Fibonacci sequence is a number pattern that was discovered and introduced in the 13th century by the Italian mathematician Leonardo of Pisa,… As I have said many times, you should always consider trading volume when assessing any trading opportunity.

Do you use Fibonacci retracement and extension levels in your own trading? Do you use different techniques than the ones I’ve described above? This creates a Fibonacci projection in the direction of the swing, marking your https://1investing.in/ potential take profit levels accurately. StocksToTrade has this tool, along with tons of other tools and indicators. It comes loaded with easy-to-read charts, built-in scans, watchlist capabilities, and so much more.

Fibonacci Retracement and Extension are harder to trade than they look. These levels are best used as a tool within a broader trading system. While trading with Fibonacci retracement and Extension It is essential to understand that Fibonacci Levels are a confirmation tool. Due to this reason, Fibonacci is best used alongside other technical tools and indicators such as Trend lines, RSI, Volume, Moving averages, and MACD.